The media are once again obsessing about the economy, or more accurately the lack thereof, to a back-drop of procrastinating politicians who are no more qualified to administer public finances than chimps are to perform brain surgery.

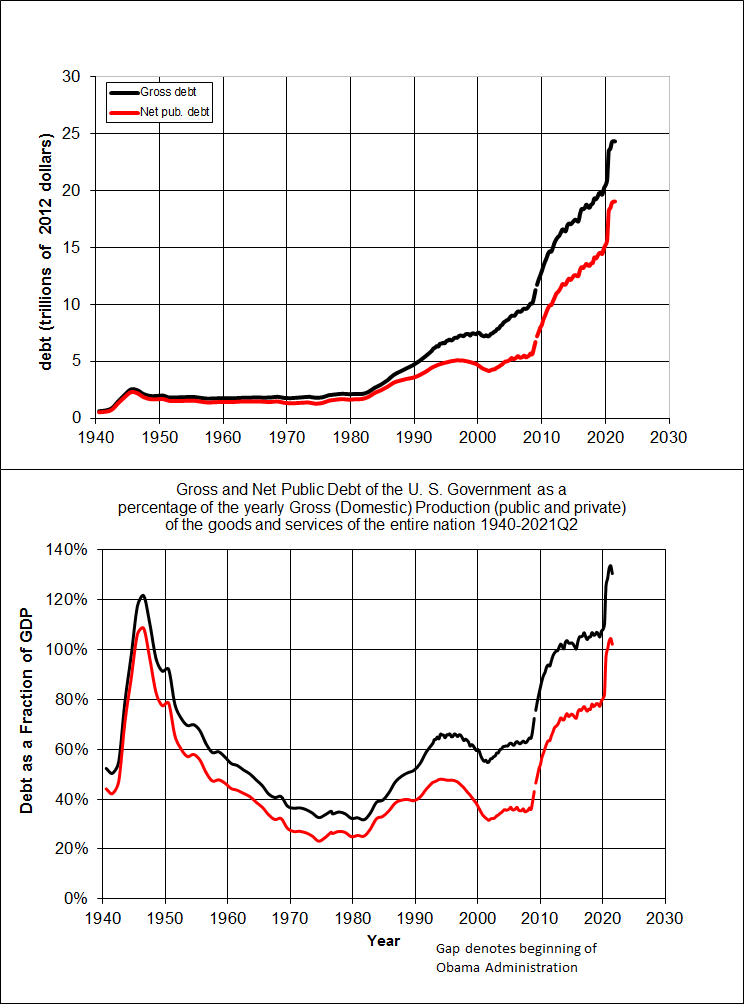

Everyone seems to accept that a country’s economy shall be measured by the ratio of its public debt to its GDP. I question this, on the grounds that whilst America’s 8.5 trillion dollars is a lot of debt, it represents about 27’000 per inhabitant, which doesn’t really sound that bad. The Icelandic 15 billion dollar debt pales in comparison, but per inhabitant it’s 47’000, which is nearly double that if the USA.

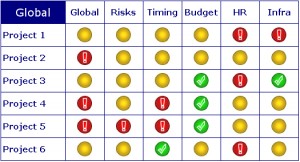

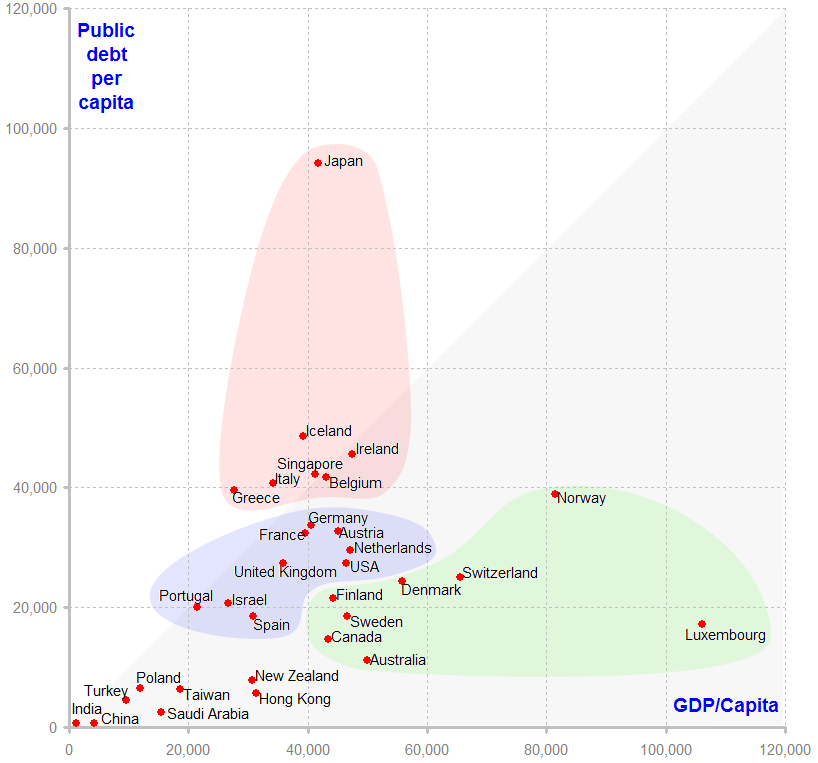

Here’s the Public Debt versus GDP for a cherry-picked set of countries, essentially the developed and significant nations:

The numbers are in USD, source CIA Factbook, IMF and World Bank, in this spreadsheet PublicFinances.xls. The horizontal scale shows productivity, the vertical scale measures indebtedness. The grey triangle encompasses those countries whose public debt is less than a year’s GDP.

There are three coloured clusters, which group those who have similar economic habits.

- The Spendthrifts, with debt exceeding GDP. Japan has been trying to kick-start its economy for over a decade, it clearly hasn’t worked. That Iceland, Ireland and Greece are heavily in debt is hardly a surprise, but I didn’t expect Belgium and Singapore to be here.

- The Western Norm, with debt between 50% and 100% of GDP. Essentially the rest of Europe and the USA. Israel’s economic habits, predictably, are the same.

- The Cautious, with debt less than 50% of GDP. Here we have the Nordic countries, the true bankers and unexpectedly, Canada and Australia.

The others make for a few interesting observations.

China and India, regularly upheld as models of economic development, are still in abject poverty at the individual’s level. When average inhabitant generates 4$/day (India) or even 19$/day (China), even a homoeopathic increase in employment will give you 10% growth a year; certainly not a notable achievement. To put that into perspective, if China’s GDP increases by 10% (compounded) every year, it’ll reach Germany’s current productivity in 2035. I’m not holding my breath.

Despite their immense income from oil, the average Saudi’s income is barely a third that of an Irishman (but the Irishman has twenty times the debt).

Finally, for all the current fretting over the American debt, it’s comparatively modest in relation to the population. The Greek and Irish economies are getting lots of publicity, but there are others whose public finances are much worse. Italy, Belgium, Iceland and above all Japan are going to have a much rougher time putting their houses in order.

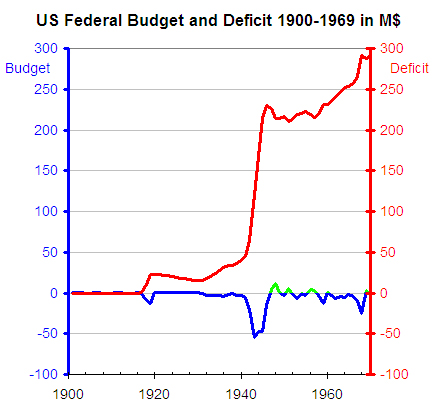

Source

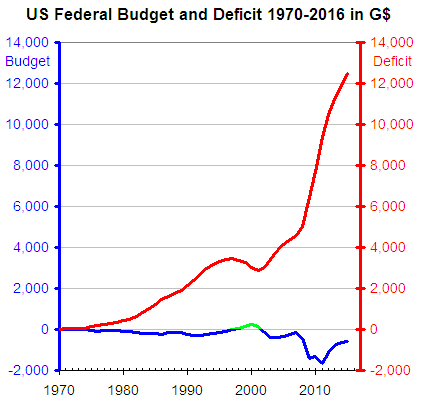

Source