Yesterday evening I was fortunate to be amongst a select few who had the privilege to be invited to hear the investment advice of the chief strategist of a major Swiss bank. (I should mention at the outset that the vast majority of the audience’s reference currency is the Swiss franc.)

The speaker was clearly an erudite man and his delivery was flawless. The underlying theme of his speech was divergence in today’s economy: in interest rates, in GDP, in unemployment, in central banks’ strategies, and so forth. Render unto Caesar, his presentation was concise, well-researched and extremely persuasive.

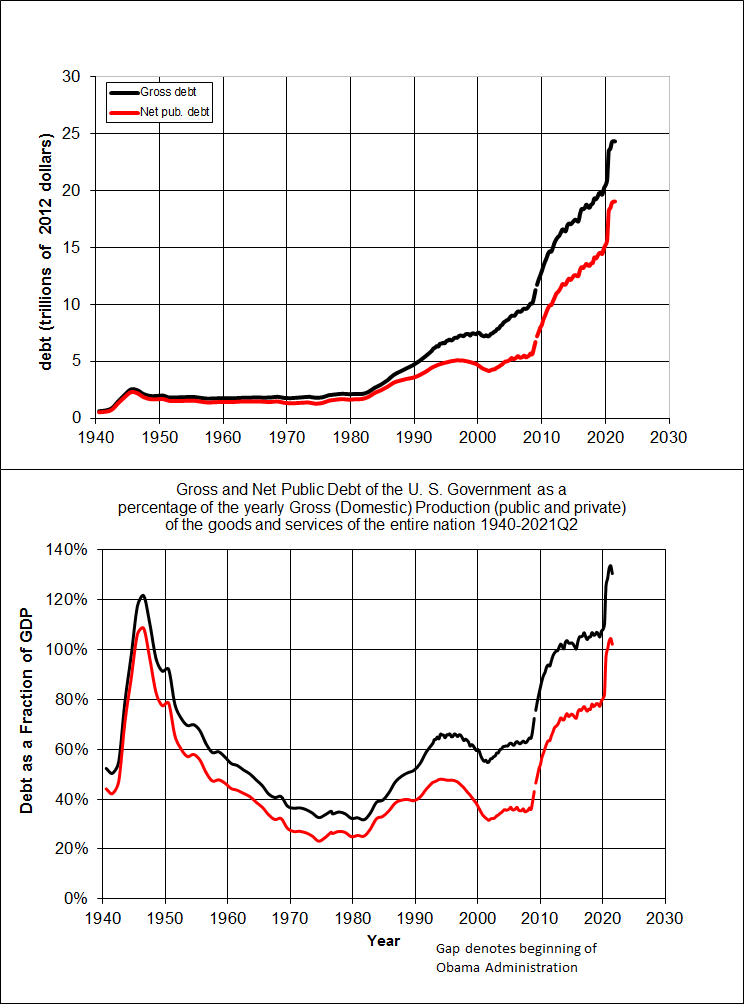

The conclusion of his argument was the bank’s investment strategy. In a nutshell, Swiss and European equities present few opportunites. On the other hand, the USA appears to have left recession and is showing strong growth perspectives, which he estimated at around 6%. The bank’s strategy is thus to move their clients’ assets to Swiss and European gilt of the highest quality for portfolio protection and to US blue-chips for revenue.

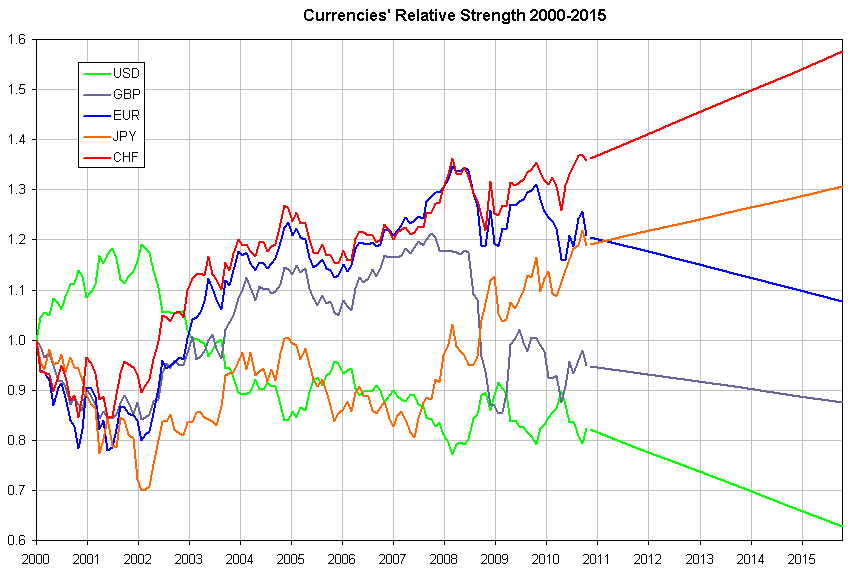

When questioned on the Swiss National Bank’s strategy of locking the Swiss franc to a floor of 1.20 CHF/EUR, he was of the opinion that the floor to the Euro would be replaced by a floor against a basket of currencies, probably EUR/USD/JPY, sometime in 2015.

Were I to have followed his advice, this morning, first thing, I would have moved my investments into US blue-chips, the stocks that participate in the Dow-Jones Index: American Express, Boeing, Caterpillar, etc. in the hope of a return of some 6% instead of the measly percent or two that I get on Swiss franc holdings.

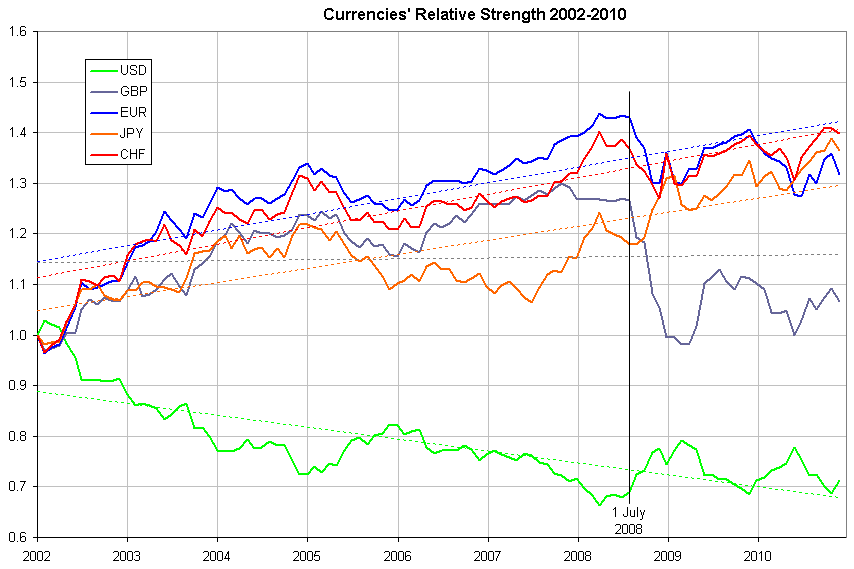

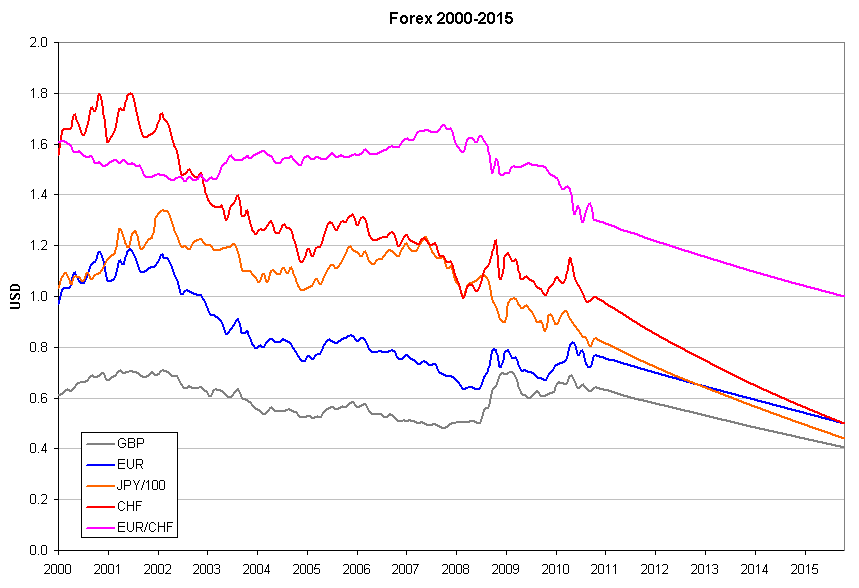

With the most tragic timing for our strategist, some 14 hours later the Swiss National Bank announced that it had abandoned the 1.20 floor. The effect was instantaneous: the EUR and the USD crashed against the CHF, settling at day-end to ~0.86CHF/USD and CHF/EUR at a similar rate.

Had I bought those American shares some hours previously, I would have taken a 15% hit on my portfolio in so-many hours; even if the strategist’s predictions come true, I’ll have to wait two and a half years before breaking even.

There are several lessons to be learned from this story:

- Despite everything that your banker, hand-on-heart, assures you, he has no interest whatsoever in your financial well-being. His sole aim in life is to persuade you to trade your holdings as often as possible so that he can gather a maximum commission. If, despite the commissions, you make money, he’ll congratulate himself on having helped you. If you lose money, he’ll appear heart-broken at your misfortune, which was entirely due to the unfavourable market.

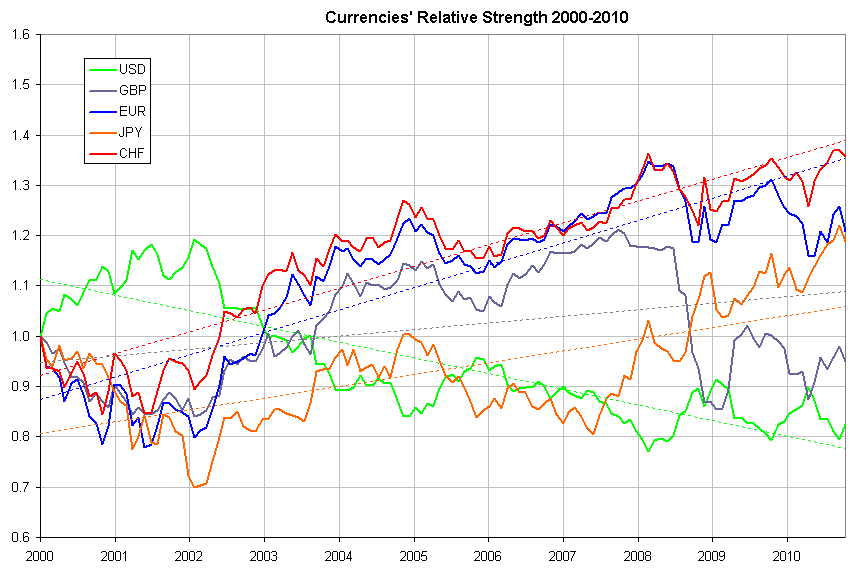

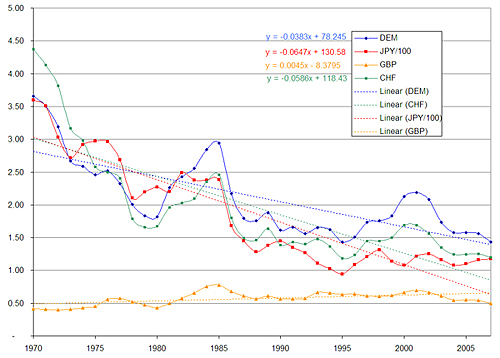

- If your reference currency is the CHF and you invest in higher-yield USD-labelled assets, you’re exposed to the CHF/USD exchange risk. Momentarily you might get away with it; as this example shows, you are likely to take a caning.

- Inversely, if your reference currency is the EUR and you buy CHF assets, your yield will be much more frugal… but your capital will be better preserved.

The take-away from all this is that in today’s liquid markets there is no free lunch. If your ambition is to receive the rate of inflation plus a whisker on your investments, there’s a strong likelihood that you’ll get it. If your ambition is get 6%, be prepared to lose 15% momentarily when things go tits-up.

P.S. For those whose mother-tongue is not English, the title is a pun

Source

Source