A year ago I wrote an article predicting that the US dollar would be worthless, against the Swiss Franc and the Japanese Yen, by around 2020. A year has passed and the US dollar has been falling in line with my prediction, so I felt it might be interesting to re-visit the subject with a slightly different tack. Also, today seems like an auspicious date for doomsday predictions.

Rather than dealing with absolute exchange rates, I set out to try and show the relative strengths of currencies amongst themselves. To illustrate, let’s suppose that a glass of wine costs 5 USD.

- On day one, we buy a 100mL glass with a dollar’s worth each of USD, GBP, EUR, JPY and CHF.

- A month later, we need a refill. The wine still has the same value, but the exchange rates have changed.

- Suppose GBP has risen by X% (and nothing else has changed). As we’re buying the wine with equal fifths of each currency, the USD’s value must decrease by X%, thus we will to pay more USD and less GBP.

- These increases and decreases change the relative strengths of the currencies, and it is this that we shall study.

This is nothing more than my own version of the Dollar Index. The maths is simple, as you may surmise from this Excel spreadsheet: forex2010

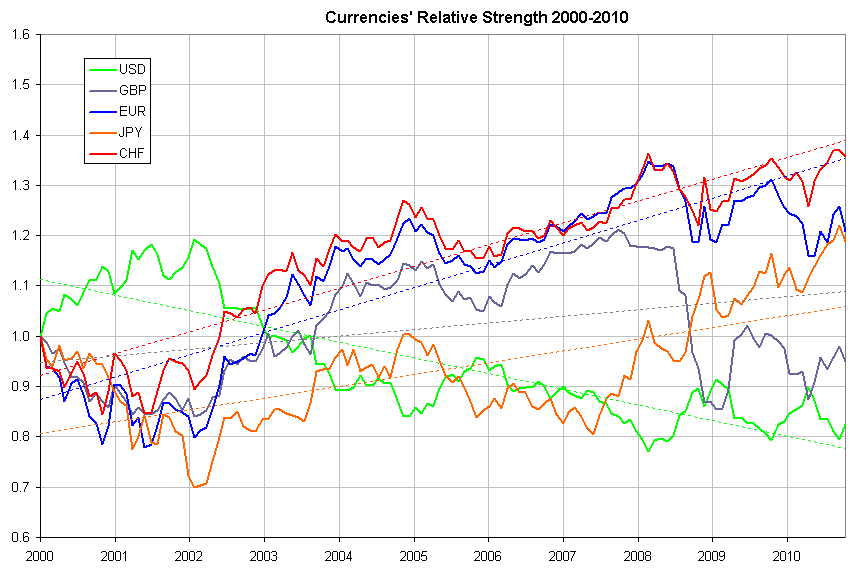

A first look over the past decade seems to illustrate some trends (click to enlarge):

The first 2 years show a pronounced strengthening of the USD, in the aftermath of the dot-com boom, but as of 2002 the USD has been declining steadily. The Federal Reserve Bank of Cleveland wrote an eloquent paper suggesting that the decline was due to the US current account deficit. This correlation held for a few years, but the USD continued to fall even when the account deficit started diminishing in 2006. I find it reassuring that the experts’ tea-leaves are no better at forex predictions than mine.

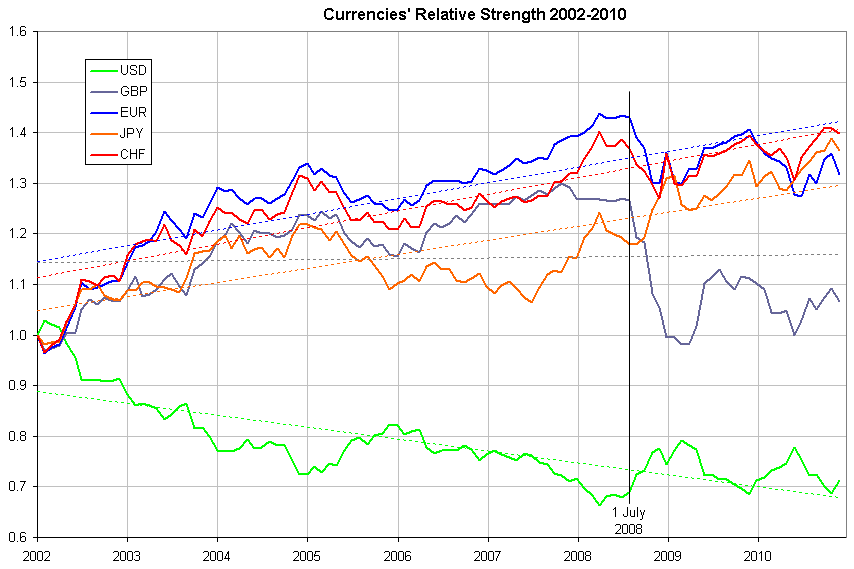

Moving on, if we set the starting point in 2002, the picture becomes much clearer:

Notice that the stock market crash of 2008 occurred on the 16th of September 2008, yet the currencies tumbled 6 weeks earlier. The documented mass buying of USD and JPY started then, not in September. I wonder why?

From 2002 to 2008, the EUR was clearly the strongest currency, even through the crash, and things remained relatively rosy until Greece admitted to cheating in its financial reporting and more than doubled its deficit in late 2009. The Greeks were followed by the Irish, the Portugese, et al in a landslide where most of Europe had to own up to the vast borrowing over the past decade.

For the USD, its been downhill pretty well all the way. 2005 showed a slight rally, at least in part due to the Chinese severing the dollar peg mid-year. The second rally during the 2008 crisis was due solely to panic selling and Obama’s election in January 2009 created but a short-lived blip. Finally, the first half of 2010 saw the USD gaining some lost ground, but it was quickly reversed once the Fed starting printing money in earnest.

Returning to the glass of wine analogy, if in 2000 you held Swiss Francs, today you’d get a 136mL top-up; if you held US dollars, you’d only have 82mL in your glass. If you see the glass half-full, that’s a 60% loss; if you see it half-empty, it’s a 66% loss, either way it’s a huge difference.

My predictions

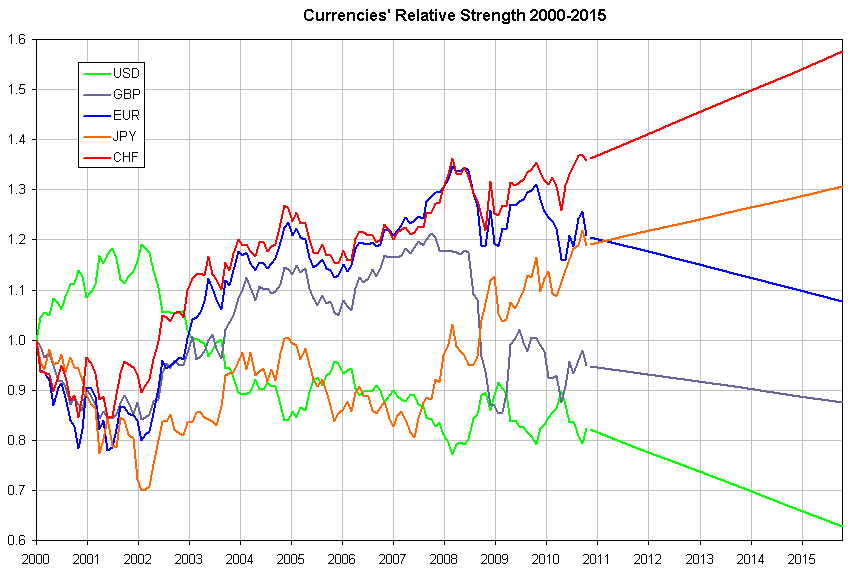

The Americans have chosen to get rid of their debt by devaluation. They don’t care, it’s not their loss. I’m very bearish and if the Chinese start selling their T-Bills in the not-so-distant future, the USD will become worthless overnight.

The Brits will take their medicine better than most, but the GBP will continue to lose value steadily for many years to come.

Europe will never really get its act together, simply because a single currency doesn’t make a single mentality. Issuing more and more bonds to buy back yesterday’s borrowing is just a stop-gap solution to delay the inevitable devaluation of the Euro.

The Japanese, industrious and disciplined, will grind on and climb steadily back to a comfortable position, exactly following the slope of the last decade.

For lack of a floating rate, it’s impossible to foresee how the Yuan will progress, but even cave-dwellers can see that it can only be upwards.

Finally, Switzerland, as usual, will remain a haven for both clean and slightly-soiled money. Their relations with their European neighbours will degrade (for a good part due to jealousy), and like the Yen, I predict that the CHF will continue on its current slope.

Graphically, here’s how I see the relative strengths:

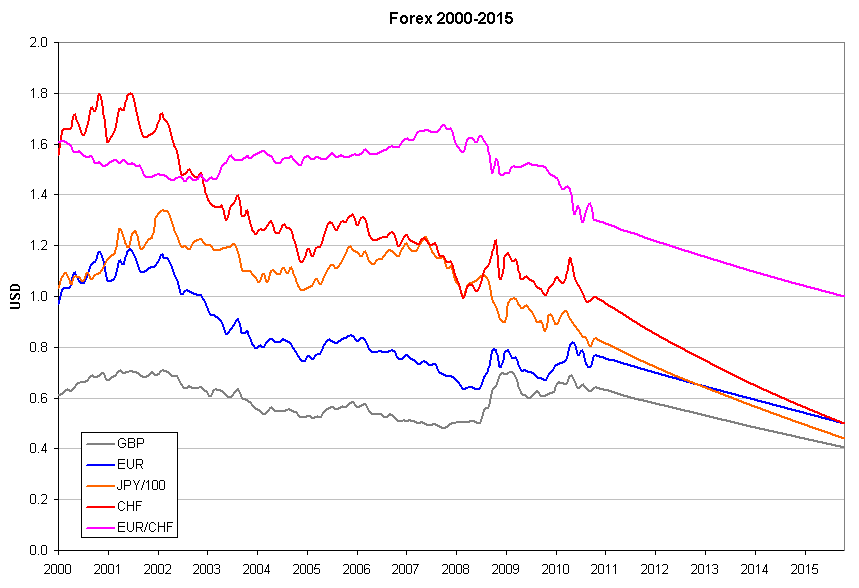

which in forex terms, looks like this:

In summary:

- The GBP will fall more or less in step with the EUR

- Near the end of 2012, we’ll see 100 JPY = 1 EUR

- At the end of 2015, the big bang when 1 CHF = 2 USD = 2 EUR.

Remember, you read it here first.