The USD has dropped pretty well back to parity with the Swiss Franc.

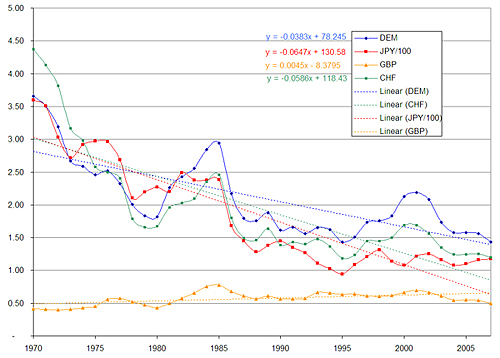

Based on the forex rates since 1970:

Source: Pacific Exchange Rates

This extrapolation suggests that the USD will be worthless:

– against JPY in 2018

– against CHF in 2020

– against EUR in 2042 (DEM in graph, fixed rate 1.95583 since 31/12/1998)

As the graph also suggests, the GBP, which more or less matches the USD, will become worthless in the mid 2020’s.

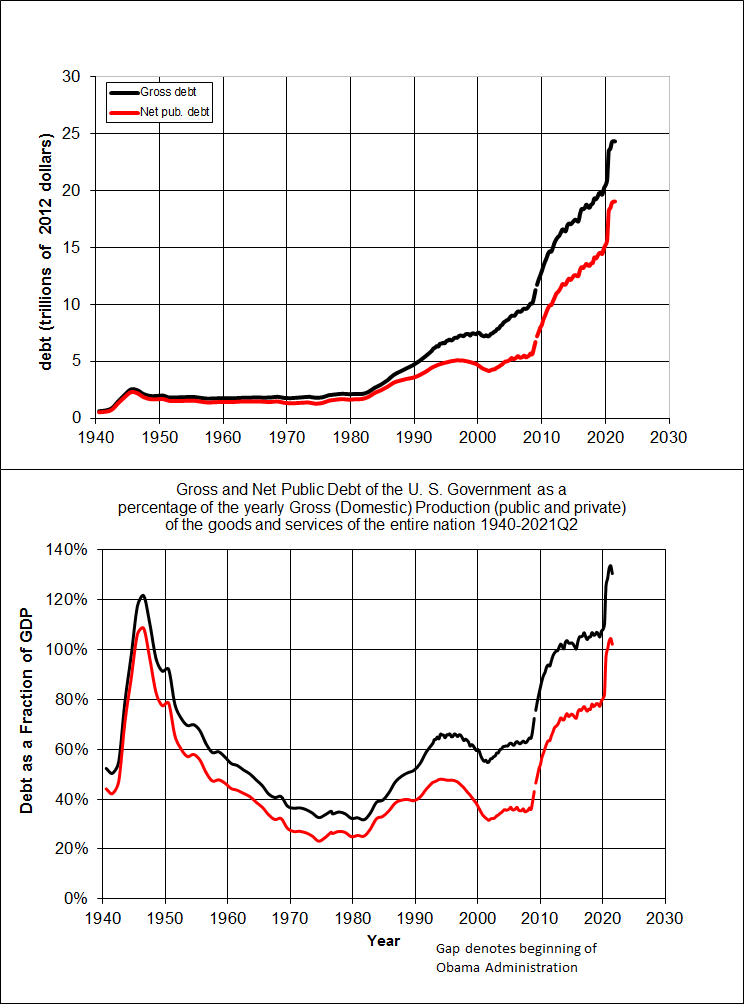

Of course, as any investor knows, past performance doesn’t predict anything in the future. Nonetheless it would seem that the trend will not only continue, but is likely to sharpen. The reason for this is simple; the U.S. government is borrowing and printing money at a heretofore unseen rate:

Source www.whitehouse.gov

Source www.whitehouse.gov

and as every investor also knows, borrowed money has to be re-paid sooner or later.

In my opinion it will be sooner rather than later. Nearly 50% of U.S. debt is held by the Chinese and Japanese:

Source www.treas.gov

At some point the pain of holding securities whose value is continuously decreasing will exceed the perceived benefits. When that happens, U.S. creditors will start selling and the result can only be further devaluation of the dollar.

Nay-sayers will argue that the Chinese will soon have to devalue the Yuan. Maybe, but once the Yuan were to be floated, there’s no good reason for it’s value to lower, quite the opposite given their balance of payments.

The other argument is that the U.S. could raise the interest rate on the USD. In the short-term, this would certainly produce a buy signal, but in the long run this will fail, simply because the dollar will devalue more or less in step with the increasing interest rate. Let’s face it, a bond that pays, say, 15% p/a has been and always will be a junk bond, even if it’s printed by the U.S. Treasury.

As the Chinese proverb says “We are going to live in interesting times”