The European Union has decided to bail out the Cypriots on the condition of imposing a 9.9% one-off tax on holdings over €100’000 deposits in Cypriot banks and 6.7% below €100’000. The justification is that Cyprus only represents 0.2% of the EU GDP and the holdings in question are held mostly by rich Russians and a handful of under-represented Brits. Be that true or not makes no difference; citizen X living in Cyprus has exactly the same rights as citizen X living in France, Germany or wherever. Unilaterally confiscating a citizen’s assets without due cause is not only unacceptable, it is theft. Were my government to propose such a measure, my instinctive reaction would be to buy a weapon; for if my basic property rights are no longer secure, there’s little left else to lose.

The European Union seems close to making a law that limits excessive bonuses. Few will disagree that the finance industry needs to be curbed, and the intention is good. The problem is in the method proposed; no matter how carefully it will be worded (the text apparently runs to over 1’000 pages), they’ll always be someone smarter to find a work-around.

The wiser and far more concise solution problem was proposed by the Swiss entrepreneur Thomas Minder in the initiative he made back in 2008. Here is an English translation, which I made from the official German and French texts:

The Swiss Federal constitution of 18 April 1994 is completed as follows:

Article 95, alinea 3 (new)

In order to protect the economy, private property and shareholders and to ensure sustainable management of businesses, the law requires that Swiss public companies listed on stock exchanges in Switzerland or abroad observe the following rules:

- Each year, the Annual General Meeting votes the total remuneration (both monetary and in kind) of the Board, the Executive Board and the Advisory Board. Each year, the AGM elects the President of the Board or the Chairman of the Board and, one by one, the members of the board, the members of the Compensation Committee and the independent proxy voter or the independent representative. Pension funds vote in the interests of their policyholders and disclose how they voted. Shareholders may vote electronically at a distance; proxy voting by a member of the company or by a depositary is prohibited.

- Board members receive no compensation on departure, or any other compensation, or any compensation in advance, any premium for acquisitions or sales of companies and cannot act as consultants or work for another company in the group. The management of the company cannot not be delegated to a legal entity.

- The company statutes stipulate the amount of annuities, loans and credits to board members, bonus and participation plans and the number of external mandates, as well as the duration of the employment contract of members of the management.

- Violation of the provisions set out in letters a to c above shall be sanctioned by imprisonment for up to three years and a fine of up to six years’ remuneration.

Article 197 chapter 8 (new)

Pending implementation of the law, the Federal Council shall implement legal provisions within one year following the acceptance of article 95 alinea 3.

The genius of Minder’s text is that instead of setting limits on bonuses, it simply forces shareholders to approve them every year, whilst ensuring that it’s the real shareholders that vote.

We’ll be voting on it this weekend (I already voted for) and it seems that it has a good chance of passing. If it does,

Minder’s text was passed on the 3rd of March 2013 by all the counties and an astonishing 67.9% of the voters. Of the 183 initiatives submitted to the vote in Switzerland since 1893, only 21 (8.7%) have been accepted. 67.9% is the 3rd highest score ever obtained by a popular initiative. The highest score, 83.8%, was obtained in the 1993 initiative to make the 1st of August a National holiday; hardly ground-breaking. The 2nd highest score, 71.4%, was for the 1921 initiative on international treaties.

I predict that the concept will gradually be adopted globally and Thomas Minder will be recognised as the father of a new era in corporate governance.

1. It is difficult to find an exact translation of Abzocker. Cheater, swindler, deceiver and liar are all close. Abzockerei literally means rip-off, but Abzockerei isn’t slang. Scam is another synonym.

The upcoming presidential election in the USA brings some interesting candidates on the republican front. We have:

- Mitt Romney, who believes in a church founded by one Joseph Smith, who was directed to a buried book written on golden plates, containing the religious history of an ancient people. Conveniently, the angel took the plates back once Smith had translated them, but in a nutshell, american indians are in fact descendants of jews who emigrated to America. Even those with a faint knowledge of the bible will recognise the plagiarism.

- Ron Paul, raised a lutheran but now a church-going baptist, appears to be saner, but nonetheless endorses using the 1st amendment to ensure that religious speech is above the law (as long as it’s lutheran/baptist, of course).

- Newt Gringrich, also raised as a lutheran but now a catholic, tellingly said in a 2011 appearance in Columbus, Ohio: “In America, religious belief is being challenged by a cultural elite trying to create a secularized America, in which God is driven out of public life.”

What, I ask myself, is the difference between these fruit-cakes and muslim extremists? Or have they all forgotten the treaty of Tripoli?

The media are once again obsessing about the economy, or more accurately the lack thereof, to a back-drop of procrastinating politicians who are no more qualified to administer public finances than chimps are to perform brain surgery.

Everyone seems to accept that a country’s economy shall be measured by the ratio of its public debt to its GDP. I question this, on the grounds that whilst America’s 8.5 trillion dollars is a lot of debt, it represents about 27’000 per inhabitant, which doesn’t really sound that bad. The Icelandic 15 billion dollar debt pales in comparison, but per inhabitant it’s 47’000, which is nearly double that if the USA.

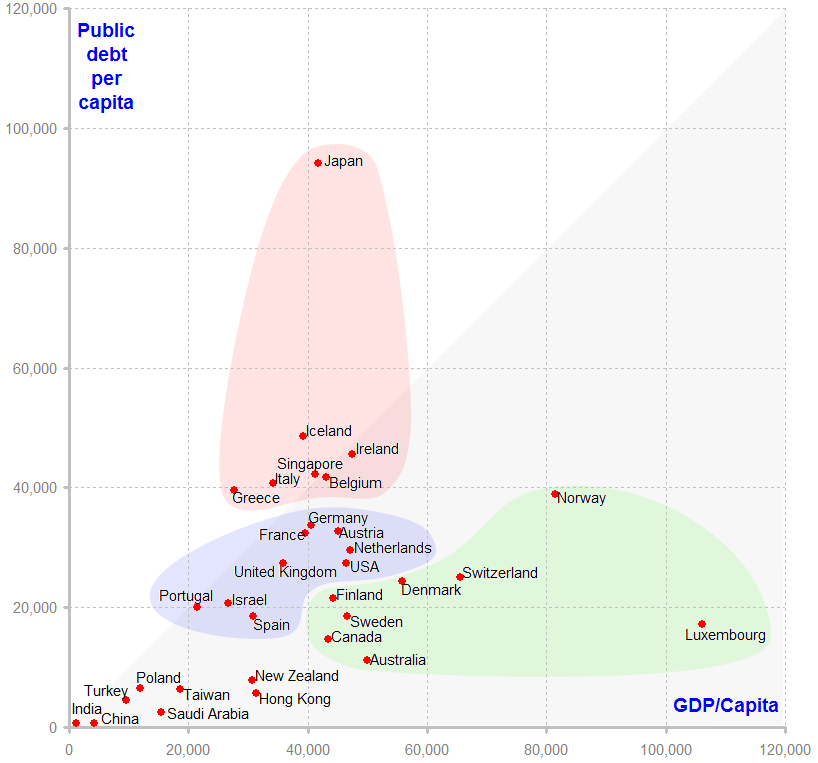

Here’s the Public Debt versus GDP for a cherry-picked set of countries, essentially the developed and significant nations:

The numbers are in USD, source CIA Factbook, IMF and World Bank, in this spreadsheet PublicFinances.xls. The horizontal scale shows productivity, the vertical scale measures indebtedness. The grey triangle encompasses those countries whose public debt is less than a year’s GDP.

There are three coloured clusters, which group those who have similar economic habits.

- The Spendthrifts, with debt exceeding GDP. Japan has been trying to kick-start its economy for over a decade, it clearly hasn’t worked. That Iceland, Ireland and Greece are heavily in debt is hardly a surprise, but I didn’t expect Belgium and Singapore to be here.

- The Western Norm, with debt between 50% and 100% of GDP. Essentially the rest of Europe and the USA. Israel’s economic habits, predictably, are the same.

- The Cautious, with debt less than 50% of GDP. Here we have the Nordic countries, the true bankers and unexpectedly, Canada and Australia.

The others make for a few interesting observations.

China and India, regularly upheld as models of economic development, are still in abject poverty at the individual’s level. When average inhabitant generates 4$/day (India) or even 19$/day (China), even a homoeopathic increase in employment will give you 10% growth a year; certainly not a notable achievement. To put that into perspective, if China’s GDP increases by 10% (compounded) every year, it’ll reach Germany’s current productivity in 2035. I’m not holding my breath.

Despite their immense income from oil, the average Saudi’s income is barely a third that of an Irishman (but the Irishman has twenty times the debt).

Finally, for all the current fretting over the American debt, it’s comparatively modest in relation to the population. The Greek and Irish economies are getting lots of publicity, but there are others whose public finances are much worse. Italy, Belgium, Iceland and above all Japan are going to have a much rougher time putting their houses in order.

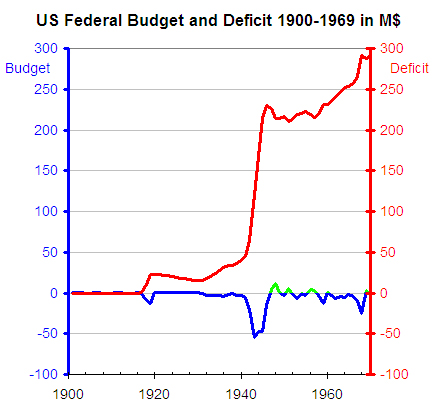

The Democrats and Republicans are slogging it out, trying to find a way to reduce the US debt. A laudable effort, but frankly, it’s pissing in the ocean. To see the big picture, we’ll take a look how the US government has been running its shop over the last century or so. Take the first half of that period, up until 1970, when the gold standard was abandoned. Notice that all numbers are in millions of dollars:

The second World War made a nasty dent in the finances, but that’s perfectly understandable. I’ve shaded the years where the books showed a ‘profit’ in green; there are precious few and the amounts are insignificant.

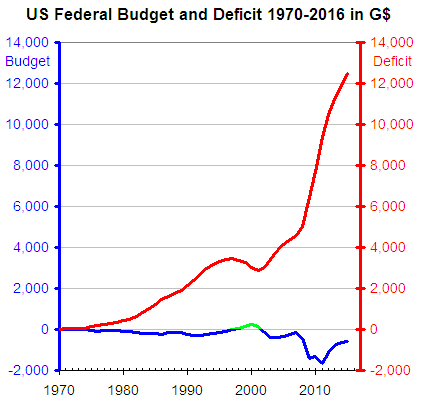

Since 1970, the picture changes drastically, we have to multiply the scale by a factor of 50’000; we’ve moved from millions to billions:

You might notice, correctly, that the debt in 2011 is shown around 9.6 trillion, when it is in fact 14.3 trillion. Presumably there’s another 5 trillion that was borrowed somewhere; a trifle that we’ll ignore.

The message to take away here is that the US government has balanced its books in 4 years out of the last 40. Perhaps more telling is that those 4 rare years are thanks solely to the dotcom bubble and the true value is directly correlated to the main thing it generated: hype.

The average American thus owes some 47’000$ on behalf of his government (and an average of 7’000$ on his credit card, but that’s another story).

Put in household terms, this is like earning 100’000 a year, spending 176’000 and borrowing a further 19’742 to pay the interest on the 657’864 that you borrowed in previous years.

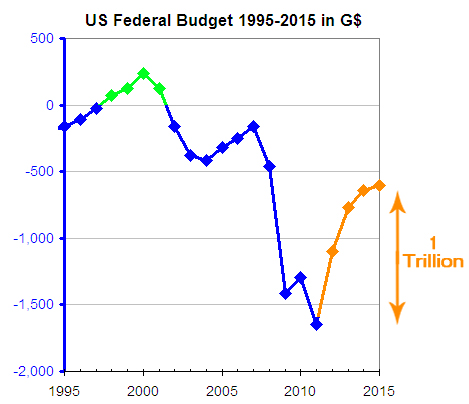

Let’s zoom in on how the White House sees that debt evolving:

The dotcom money is put into perspective and we get to the part where I’m asking myself who’s been smoking something dubious. Remember, these are the numbers I obtained from the White House, which predicts that the debt will be reduced by 1’000’000’000’000$ in the next 4 years.

Thus, every American man, woman and child is going to reduce spending by 833$ every year, not to eliminate the debt, but simply to halve the yearly budget deficit.

The Americans are definitely in the shit; but the shit they’re in isn’t the shit that they’ve been smoking.

The media are lathering us all up to the prespective of a great depression, matched only by 1929. Obama is just hanging in on page 4, and only because some deranged young idiot was supposedly plotting to assassinate him. As for McCain and Palin, they’ve completely dissapeared from the news radar, at least here in Switzerland.

I never cease to be amazed at how short peoples’ memory is. The stock market has gone through innumerable crises, the 1973-1974 wiped 45% off the DOW, black Monday (1987) took 22.6% off the DOW and the .COM bubble in 2000 cost speculators (and others) about $5 trillion. The world’s banks employees, motivated by bonuses that bear no relation to their true added value have been playing the market for years and now we are at the day of reckoning. And so what? We’ve lived through them before, we’ll live through this one again, and in 3 years the autumn-2008 meltdown will be no more than a page on Wikipedia, like the others.

But. And there is a “but” this time round. The previous disasters were accompanied by liberal doses of “well, take your medecine”. This time it’s very different. Governments suddenly made billions available to ailing banks and in the same breath announced that money for all other causes was short. Here in Switzerland, where UBS was bailed to the tune of 68’000’000’000 CHF (about the same number of dollars), the minimum interest rate on pension funds was slashed simultaneously.

Let us take a step back. In 1974 (and 1987, and 2000), we were fed the same crap. In 2006-2007, everyone was back to worshipping the incredible economy.

Will we never learn?

Quite astonishing that for once the European politicians have got their act together and addressed the financial cesspool that the banks have created. A shining performance by Sarkozy and Brown, from whom nobody expected such alacrity and cooperation.

On the other side of the pond (is Bush still president over there?), McCain is too busy slinging mud at Obama in a last-ditch effort and Paulson’s plan seems rather ineffectual by comparison to the Europeans’.

It seems that Europe is finally assuming the role it should take; with a population of some 450 million it’s about time.

I was flabbergasted to learn that the price of car insurance in Switzerland is a function of your nationality. The surcharge can be as high as 97% if your unlucky enough to be from pretty well anywhere in the sourth-eastern Medditerranean area and, curiously, anywhere in north or south America (article in French).

The insurers argument is that drivers from certain countries statistically have more accidents. Now I can follow the reasoning, the problem is that each company has wildly differing prices for a given nationality, which to me smells of poor statistics. If the sample is large, the surcharges should be approximately the same.

What’s even worse is that the no-claims bonus is aplied on the surcharged price. This means that a driver from country X, whose initial policy has a 94% surcharge, who has no accidents for 10 years is penalised forever.

Legal as it may be, this practice stinks of racism. Shame on the Swiss; are they alone in doing this?